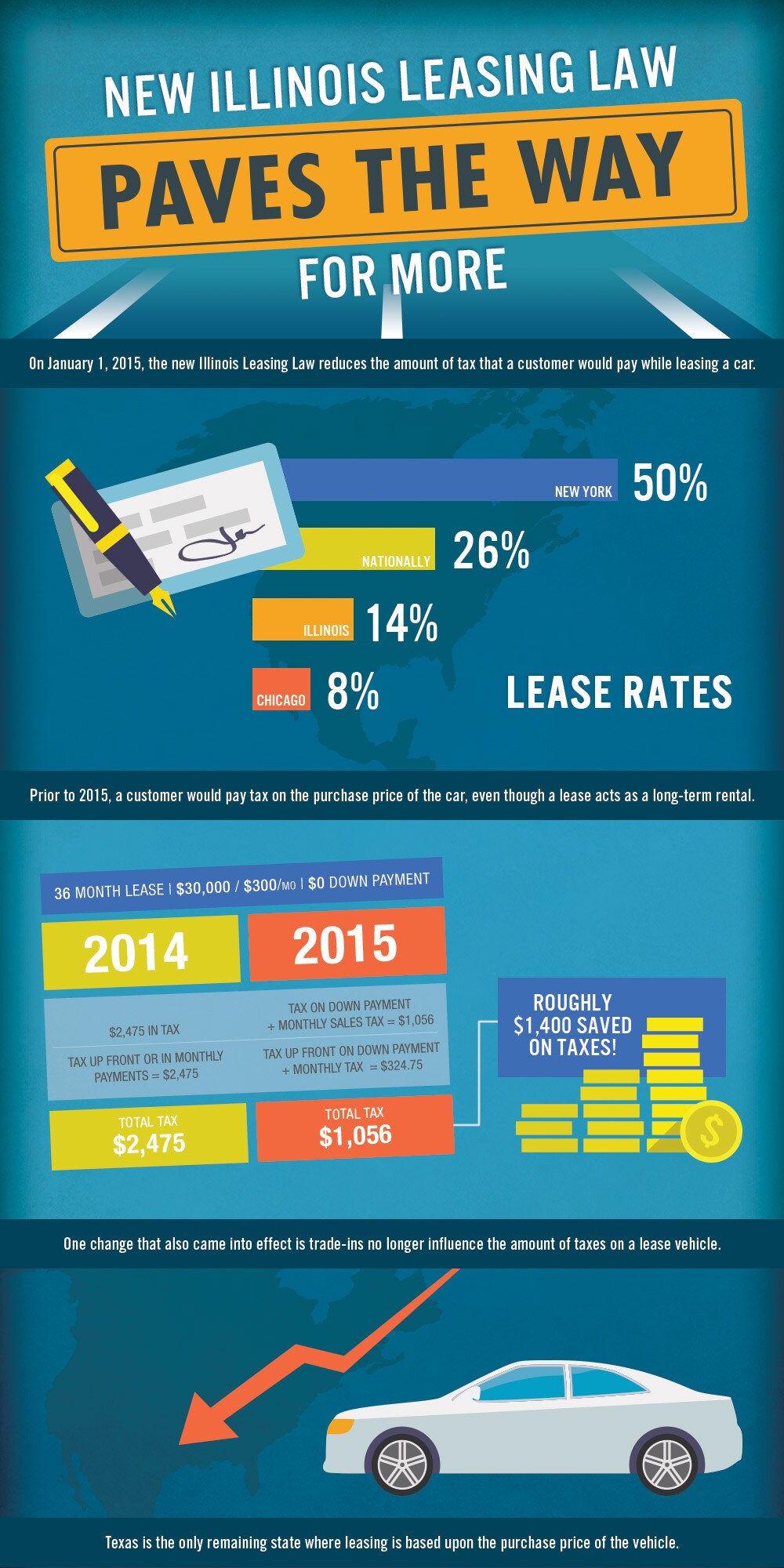

If you're considering leasing an automobile in Illinois, the state's brand-new leasing law can make the process a lot much more budget-friendly. Prior to the adjustment, consumers paid taxes on the complete acquisition cost of a rented vehicle, which resulted in higher costs, even though leases operate more like leasings. The new law, which entered effect on January 1, 2015, permits taxes to be used just to the deposit and the regular monthly settlements. This shift can lead to significant savings-- up to $1,900 in some situations. For example, a $30,000 vehicle leased for 36 months saw the overall tax obligation bill drop from $2,475 to around $1,056, a financial savings that could affect numerous consumers to think about leasing over getting.

The upgraded regulation also removed the influence of trade-ins on the tax obligation rate for leased lorries. Whether you are brand-new to renting or an experienced pro, comprehending how the new legislation impacts your bottom line can make a huge difference in how much you end up paying over the term of your lease.

Check for more info at Bill Walsh Kia Facebook Twitter

Latest Posts

EQS SUV vs. Tesla Model X - Performance and Performance Face-off

Exploring the 2024 Mazda CX-5 Trims at Jake Sweeney Mazda in Cincinnati, OH

VW Grad Program via Sierra Volkswagen – Rewarding Your Next Step

Navigation

Latest Posts

EQS SUV vs. Tesla Model X - Performance and Performance Face-off

Exploring the 2024 Mazda CX-5 Trims at Jake Sweeney Mazda in Cincinnati, OH

VW Grad Program via Sierra Volkswagen – Rewarding Your Next Step